Strategic Investments in New Ideas

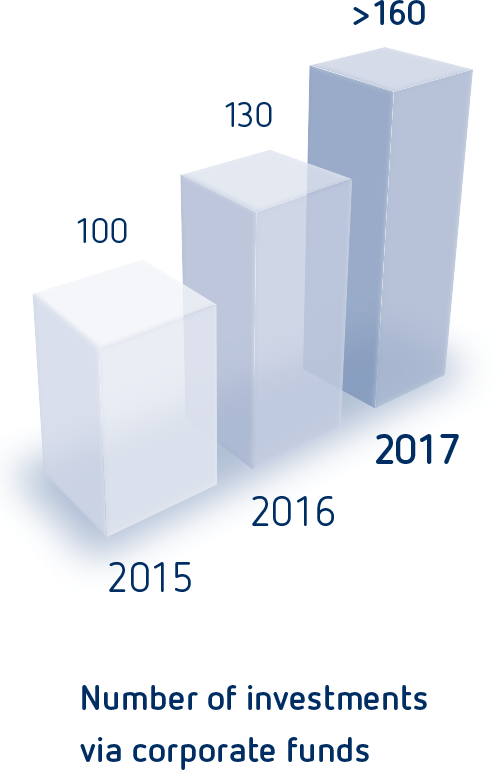

Bertelsmann Investments unites Bertelsmann’s start-up investments around the world. In focus of its activities are the strategic growth regions Brazil, China, India and the United States. Shareholdings are acquired through the strategic investment funds Bertelsmann Brazil Investments (BBI), Bertelsmann Asia Investments (BAI), Bertelsmann India Investments (BII) and Bertelsmann Digital Media Investments (BDMI). Bertelsmann owns stakes in more than 160 innovative companies via these funds.

www.bertelsmann-investments.comInvestments Highlights 2017

Global Start-Up Network Expanded

Bertelsmann continues to expand its global network of start-up investments. During 2017, the Group made more than 40 new investments around the world through the four funds of Bertelsmann Investments. The majority of the start-ups operate in business areas that are highly relevant for the Group, including innovative media offerings, e-commerce, fintech and education services. Its holdings help Bertelsmann strengthen its activities, particularly in the strategic growth regions of China, India and Brazil, and to lay the foundation for the transfer of knowledge about digital trends and promising markets. All in all, at the end of 2017, Bertelsmann held more than 160 investments via its local funds.

Worldwide Education and Training

The higher education sector is a strategic growth platform for Bertelsmann

– and accordingly an investment focus of the company's corporate funds.

In 2017, Bertelsmann further expanded its presence in India and strengthened

its activities on the subcontinent through strategic investments in

the higher education sector. Through the Bertelsmann India Investments (BII) fund, the Group acquired a stake in Eruditus Executive Education –

a company that develops executive education programs in partnership

with prestigious universities such as Columbia, Harvard and Wharton.

Bertelsmann thus complements its existing investments, iNurture and

WizIQ, in the Indian education market.

Bertelsmann also expanded its educational activities in Brazil. In 2017, together with the Bozano Investment Fund, the Group increased its stake in the online education provider Medcel via the Bertelsmann Brazil Investments (BBI) fund. Medcel helps medical students qualify for their specialization. More than 15,000 users have now prepared for their exams with the help of about 2,000 hours of professionally produced video content and a comprehensive online library. Brazil’s NRE Education Group, a university group focused on medicine and healthcare in which Bertelsmann has a shareholding, expanded its activities last year and opened a new university.

Videos Thanks to Artificial Intelligence

More and more news portals around the world use video. The start-up Wibbitz benefits from this boom, as the Israeli-American company’s innovative software uses artificial intelligence to convert texts into videos in seconds. Wibbitz specializes in the production of short news clips. At the end of October, Bertelsmann led a $20 million round of financing for the young company through its Bertelsmann digital Media Investments (BDMI) fund. Urs Cete, Managing Partner of BDMI, says: “The demand for video will continue to grow, and BDMI is accordingly excited to support Wibbitz as it pursues its further expansion.” Wibbitz's customers include renowned media companies such as Bloomberg, Reuters and Forbes.

Around the World

by Bicycle

From China into the world: the start-up Mobike, in which Bertelsmann Asia Investments (BAI) increased its stake in 2017, is rapidly driving forward the internationalization of its bike-sharing service. As of November, the Bertelsmann portfolio company was represented in Germany for the first time – in Berlin, its 200th city worldwide. Shortly before, Mobike – which was awarded the United Nations’ highest environmental honor at the UN Environment Assembly in 2017 – started in Australia, as well as in the Netherlands, Italy, Britain and the United States. The result of Mobike’s expansion: the young company reached a billion-dollar market potential.

Four IPOs

In 2017, the Bertelsmann Asia Investments (BAI) fund supported the initial public offerings of four of its holdings. It all began with the premium lifestyle platform Secoo on New York's Nasdaq (photo) in September, followed in November by the online automobile retail transaction platform Yixin Group’s listing on the Hong Kong Stock Exchange. At the end of the year, two more BAI holdings were floated on the Nasdaq: the fintech company Lexin and the digital marketing platform iClick. Altogether, seven BAI holdings have gone public to date.